One of the top priorities for lending officers of all experience levels is identifying reliable sources of mortgage leads. This article will cover three approaches: lead generation companies, lead acquisition platforms, and in-house lead gen campaigns.

Mortgage Lead Generation Companies

One of the fastest ways to get started is by purchasing mortgage leads. But if you’re going to work with a lead generation company, you need to know what you’re going to get.

Aged Leads

Aged leads are leads that showed interest a few weeks ago. These leads are more affordable than some of the other options, but that’s because most of the prospects you talk to will have already found a lender by the time you get to them.

Real-Time Leads

Real-time leads are leads that can be generated in-house or outsourced. The campaigns rely on traditional digital marketing to generate leads. Marketing automation software qualifies those leads and forwards them to agents in real time.

The biggest challenges of this method of lead generation are:

- driving traffic to your landing page, and

- converting that traffic into leads.

Live Transfer Leads

Live transfer mortgage leads are leads that generate a phone call to one of the lead generation company’s agents. If the caller is qualified, the call will be transferred to someone on your team so you can close the loan.

These are high-intent leads because they cared enough to pick up the phone, and you’re talking to them as soon as they’re qualified. So you’re not wasting time on unqualified prospects while immediately following up with hot leads.

Lead Acquisition Platforms

You can also buy leads from websites like Bankrate, LendingTree, NerdWallet, and SmartAssets. The main drawback of these leads is that they’re usually sold to more than one lender at a time, so you’ll have some competition.

But if you have great loan officers who can follow up quickly, lead acquisition platforms can be a cost-effective source of mortgage leads.

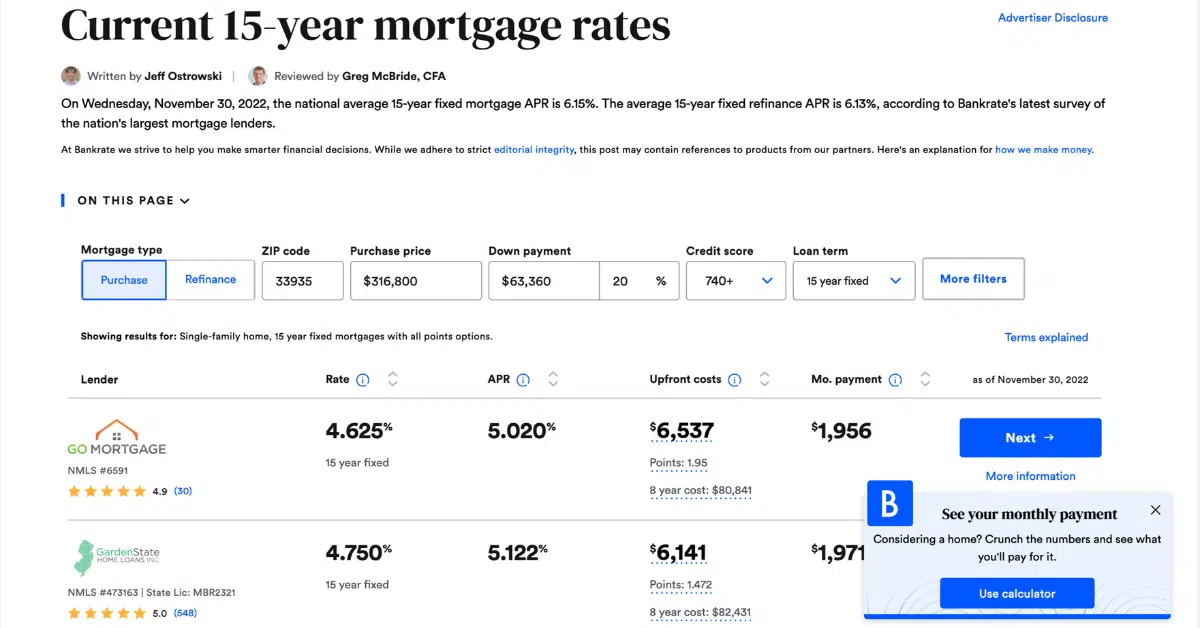

Bankrate is a good example of how it works. The company sells leads for conventional mortgages, refinance mortgages, FHA/VA mortgages, and more. The site generates traffic by offering extensive rate tables for borrowers. When someone is planning to buy a home, they can compare rates on the site.

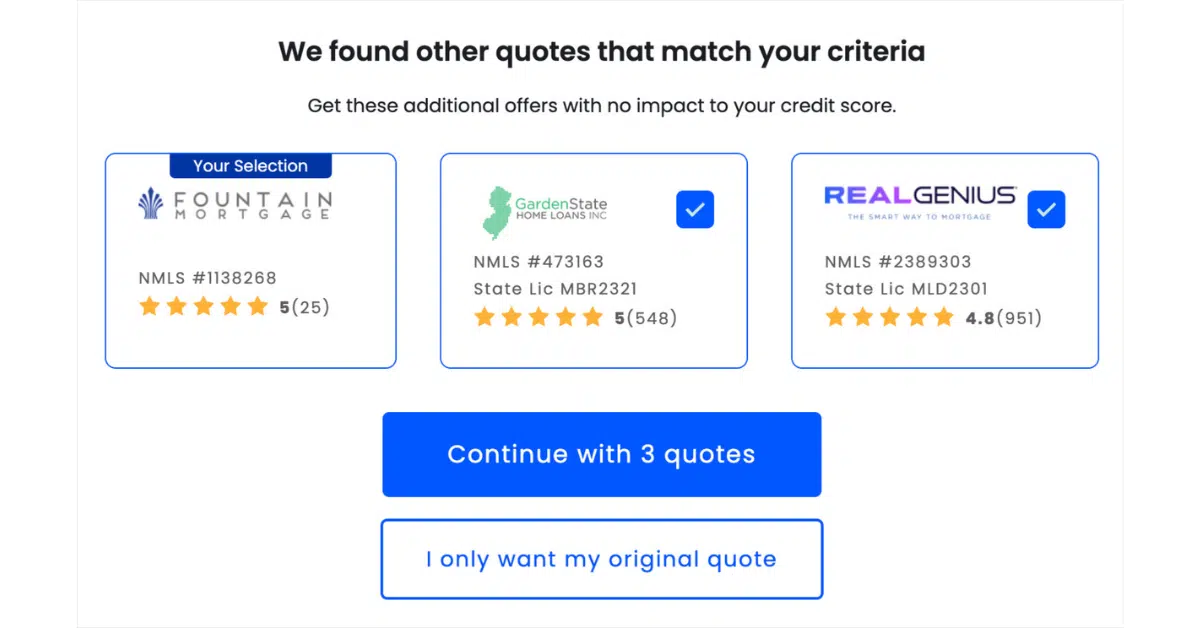

Then, the site turns that traffic into mortgage leads when visitors want to get more information on a lender. They have to fill out a questionnaire, and that information is shared with matching Bankrate partners.

Remember that even if you don’t generate a lead directly through Bankrate, prospects will often do their own research on lenders they find.

So it’s important to ensure that your website is optimized to convert that incremental traffic. Here’s how:

- Make sure you’ve got the right lead capture software

- Optimize your landing pages

- Use a visitor identification tool

Running Your Own Mortgage Lead Generation Campaigns

Another option is to generate your own leads. If you’re a loan officer, the best way to generate leads is through networking and referrals. But if you’re just starting out, you might need to try other tactics while you build your network.

As long as your employer doesn’t have a policy that prohibits its loan officers from having websites, you can generate your own mortgage leads through a combination of digital advertising and SEO.

Here are the five basic components you’ll need to do that:

- Content

- Lead Magnet

- Landing Page

- Lead Capture Software

- Traffic

Content

To rank in search engines, you’ll need to produce good quality content that answers the kind of questions qualified prospects have when looking for loans. An easy place to start is to write articles that address common questions you get each day.

Lead Magnet

Next, you’ll need a lead magnet. A lead magnet is something of value that you exchange in return for the visitor’s contact information. For example, people visit Bankrate’s website for its rate tables and then submit their contact information to learn more. But your lead magnet could be something simpler, like an ebook.

Landing Page

Your landing page is where you’ll explain the value of your lead magnet. It’s also where you’ll have the form visitors will fill out to get the lead magnet.

Lead Capture Software

Lead capture software refers to the tools you’ll use to convert your visitors into leads. You might use something simple, like a basic WordPress form plugin, or you could use a marketing automation platform that nurtures leads through email marketing.

Another tool to consider is website visitor identification. A visitor identification tool will identify up to 40% of your anonymous traffic even if they don’t fill out a form. Then you can send them email, direct mail, and other marketing communications if they don’t convert right away.

Traffic

Once you’ve got the above components, it’s time to start sending traffic to your landing page. The content you’ve created will help generate organic traffic, but if you’re in a hurry, you can advertise on Google, Facebook, and other platforms.

Generate the Mortgage Leads You Need

Working with a lead generation company, partnering with an existing platform like LendingTree, and building your own lead gen campaigns are all effective approaches to generating mortgage leads. The key is to keep trying new things until you find what works for you.